It looks like the people moving to Thousand Oaks are fleeing the nation’s decaying metropolises. Searches on Redfin for Thousand Oaks homes between February 2023 and April 2023 were highest among people residing in these cities:

- San Francisco

- Chicago

- New York

- Washington, DC

- Boston

- Kalamazoo, Mich.

- Minneapolis, Minn.

- Hartford, Conn.

- Louisville, Ky.

- Roseburg, Ore.

As for the apparently outflowing population, they are aiming squarely for the sun belt, with most choosing to leave the state. Searches by Thousand Oaks residents of homes elsewhere between February 2023 and April 2023 were centered on the following cities:

- Las Vegas

- San Diego

- Phoenix

- Bakersfield

- Dallas

- Nashville

- Houston

- Miami

- Atlanta

- San Luis Obispo

Bad News Dominates Local Housing Market

Trends are looking bad for regional home values, but tight supply is keeping some metrics elevated.

A report released by the Conejo Simi Moorpark Association of Realtors (CSMAR) on May 11 showed declines in key metrics over the prior year — fewer sales, less inventory, lower prices and fewer new listings.

Closed sales for the region, which includes Agoura Hills, Moorpark, Newbury Park, Oak Park, Simi Valley, Thousand Oaks and Westlake Village, were down 34.7 percent since April 2022. Last year, 389 homes closed sales in April; only 254 homes closed in April 2023.

Despite the lower home sales, Tim McDougal, CSMAR board president, said in a statement, “… sellers are receiving nearly 100 percent of their list price, and the month’s supply of inventory indicates that we’re still in a sellers’ market.”

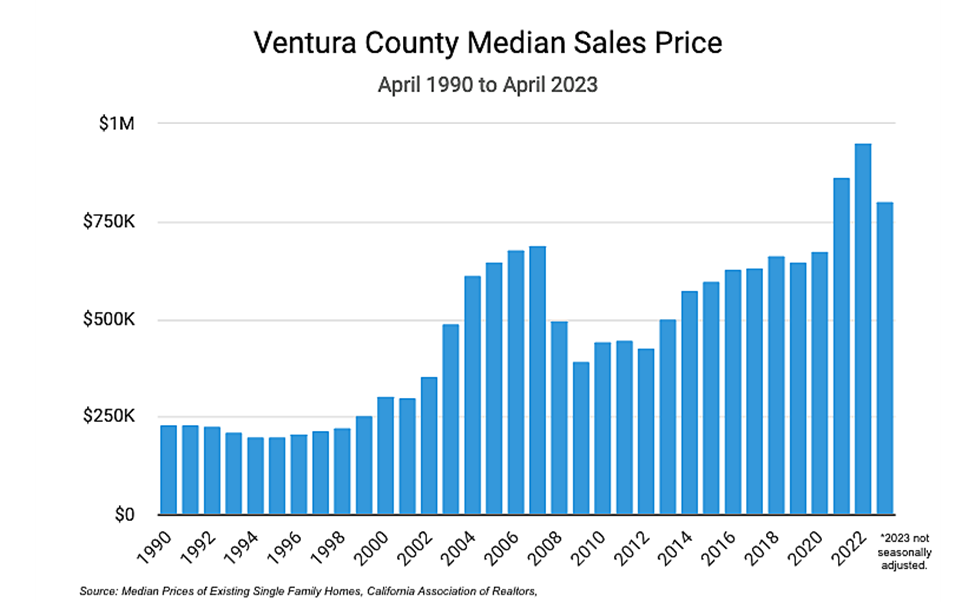

Eh, maybe. While in April 2022, sellers received an average of 105.4 percent of list price, this April, sellers received 99.8 percent of list price. The median sales price also decreased, down 12.7 percent, from $1,010,000 to $882.174.

The number of new listings also dropped sharply (29.7 percent), with 522 new homes on the market in April 2022, down to 367 in April 2023.

The number of days homes are on the market is trending upward during spring, the season most homes are typically sold. Conejo Valley homes are staying on the market 68.8 percent longer than a year ago. Average days have gone from a low of 16 in April 2022 to 27 in April 2023.

Listings priced from $750,000 to $999,000 comprised the largest category of April sales. Homes priced $1.5 million and above are selling at a lower frequency than the volume of homes they represent in the market.

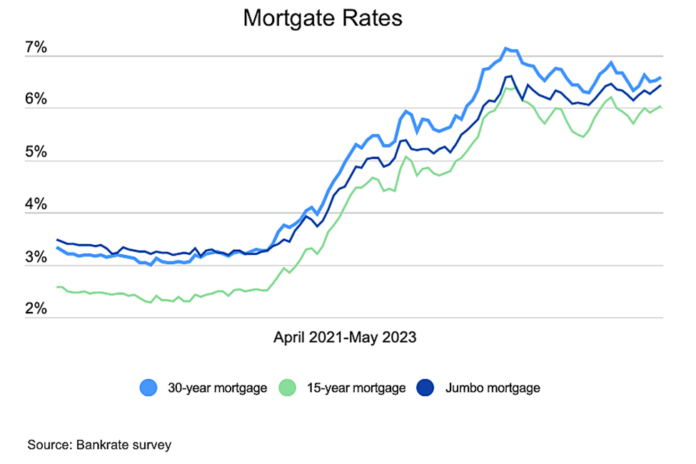

Deputy chief economist Taylor Marr of Redfin, an online real estate brokerage, said recently, “This spring’s housing market is hot but cold, with scant listings making it less active than usual but fast and competitive at the same time. The good news is that buyers are out there trying to find a seat in a game of musical chairs. The bad news is there aren’t enough chairs. A lot of potential home sales are locked up until mortgage rates come down to a level for which current owners would be willing to trade in their 3 percent rate. The problem is that’s unlikely to happen anytime soon, as although inflation is steadily coming down from last year’s record-high levels, it’s still above target.”

Historical data from the California Association of Realtors shows median home sale prices in Ventura County experienced a COVID boost during 2021 and 2022, increasing 28 percent and 11 percent, respectively, as a record number of Californians left the Golden State (see chart).

Mortgage rates for a 30-year conventional loan climbed to 6.84 percent as of press time. By contrast, rates in April 2022 were as low as 4.95 percent, and in April 2021, rates were 3.2 percent. The doubling of rates in the last two years is a significant factor for low inventory.

“[M]any financed their purchases years ago when rates were historically low, and to sell now could mean financing a new purchase at a higher rate,” reported Jennifer Sor in the Business Insider article (“The Housing Market Has Frozen Over,” May 13, 2023). “This is likely to keep inventory low and home prices elevated.”

Next-Gen Buyers

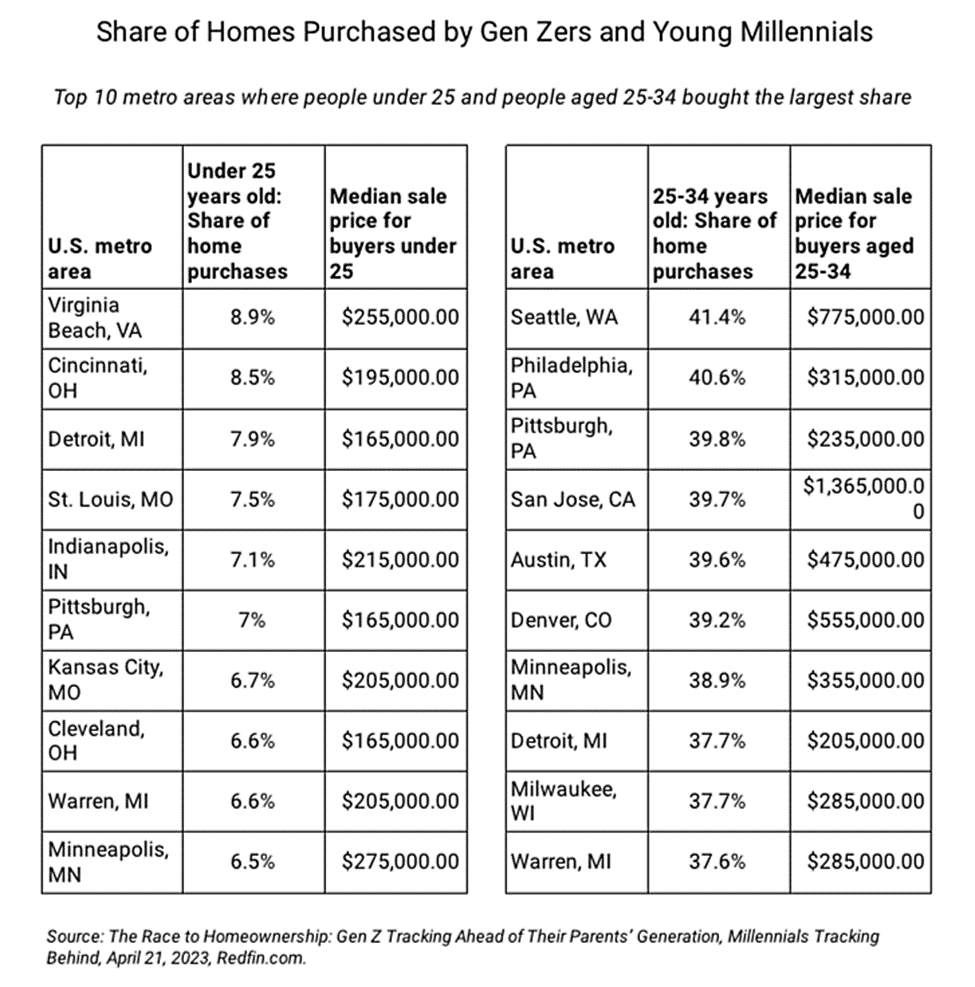

According to an April 21, 2023, Redfin article, Gen Zers (born in the late 1990s to early 2000s), are buying homes at a rate higher than their Gen X parents (born 1965-1980). Redfin found that “30 percent of 25-year-olds owned their home in 2022, higher than the 27 percent rate for Gen Xers when they were the same age.”

Millennials (born in the 1980s and 1990s) are buying homes at rates lower than their baby boomer parents (born 1946-1964), 62 percent vs. 69 percent, respectively. However, Redfin reports, “Millennials buy more homes than other generations, with 25-44-year-olds buying roughly 60 percent of homes that sold over the last several years.”

It seems the Gens have geographic preferences as well. Redfin says, “Gen Z home buyers are most common in affordable parts of the country like Virginia Beach, where they bought 9 percent of homes sold in 2022. Millennial buyers are most prevalent in job centers like Seattle, where they bought more than 40 percent of homes sold.”